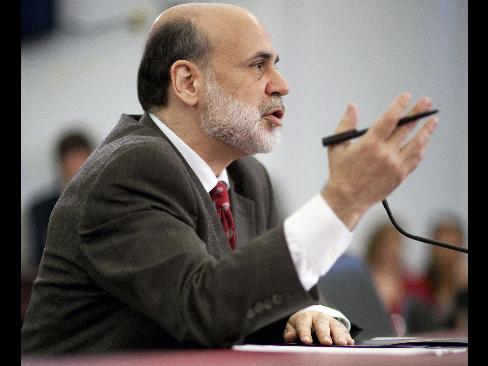

Bernanke is ‘the perfect puppet’ and a ‘total success’ for the elitists … but a total disaster for the people.

– Jim Rogers: We are going to have another Depression in the U.S. (Video):

“Mr. Bernanke has never been right. He has been in the government for six or seven years, he has never been right.”

– Marc Faber: Bernanke Is An Economic Criminal And In My Opinion He Is A Madman (06/06/09) (Video)

Such ‘competence’ needs to be rewarded by the other perfect puppet:

– Obama proposals to greatly increase the power of the Federal Reserve

Inquiring minds are reading Bernanke Flubs Tryout, Still Up for Leading Role by Caroline Baum.

Most often I agree with Caroline, but not this time.

After trashing (and rightfully so) Bernanke’s last appearance before Congress, Caroline somehow arrives at the following conclusion.

It would be hard to find someone more suited for the job of Fed chairman than Bernanke. His performance yesterday has nothing to do with his unique qualifications for the position. … Unless President Barack Obama wants a solo pilot, he would do well to tap Bernanke for a second term.

Let’s take a look at the qualifications of which Baum speaks.

Ten Qualifications

1) Bernanke is either a liar or has a memory problem. I believe the former. Either way, there is a problem when a Fed chairman cannot recall a conversation with another Fed governor over something as critical as the Bank of America/Merrill Lynch merger. See Bernanke Suffers From Selective Memory Loss; Paulson Calls Bank of America “Turd in the Punchbowl” for my take.

2) Bernanke claims to be a student of the great depression yet amazingly concludes the cause was misguided Fed policy after the stock market crash. This is nonsense. The cause of the great depression and the cause of the current depression (yes we are in a depression), is the massive expansion of credit and debt fostered by the Fed itself. Bernanke is no student of history, he is a dunce.

3) Bernanke has on many occasions promised transparency. This is an outright lie. There is no transparency and Bloomberg has filed freedom of information lawsuits requesting information that should have been disclosed. Moreover, Congress had to subpoena the Fed in regards to the Bank of America / Merrill Lynch shotgun wedding which is how we know about Bernanke’s selective memory loss. What else is Bernanke hiding?

4) Bernanke is creative. Some might think creativity is a positive attribute. It is, for a design engineer. Unfortunately creativity is not a good attribute for a Fed chairman. This whole mess was sponsored by the Fed when Greenspan got creative with interest rate policy. Bernanke is light-years more creative than Greenspan as witnessed by an amazing array of Fed lending facilities and the ballooning of the Fed’s balance sheet swapped for garbage collateral. The unintended consequences of Bernanke’s extraordinary actions are coming down the road. We do not even know what those consequences are. However, we do know that the Fed has no exit policy, and will come up with one by the seat of Bernanke’s pants on the fly. Given there is no need for the Fed at all, the last thing we need is for a creative Fed.

5) Bernanke supports policies of theft. Proof of this is easy to establish. Bernanke favors a policy of 2% inflation, and inflation is theft. How so? Inflation benefits those with first access to money: governments, banks, and the wealthy. Government benefits when property taxes rise more than wages, banks benefit by borrowing money into existence, and the already wealthy benefit by being next in line for access to cheap money. By the time those low on the totem pole have access to cheap money, asset prices are already through the moon. Moreover, those with enough common sense to avoid the bubbles, get nothing for their money sitting in the bank. The middle class has been ravished by inflation, and Bernanke supports that inflation.

Please note that Bernanke cannot even follow his own mandate. Where was Bernanke when property and commodity prices were soaring? The answer is he was ignoring them. Thus we see the one sided nature of Bernanke’s policies. He let home prices soar, and now that they are crashing looks to support them. By the way, this is not just Bernanke, this is a symptom of central bankers in general.

6) Bernanke cannot dissent. As a member of the Greenspan Fed, Bernanke went along with everything Greenspan did. It is clear Greenspan failed. Thus it is clear that Bernanke failed by supporting Greenspan’s policies.

7) Bernanke supports policies of outright fraud. Fractional reserve lending is a fraud. Please consider Murray N. Rothbard and the Case for a 100 Percent Gold Dollar in which Rothbard condemned fractional reserve banking as a violation of contract. “In my view, issuing promises to pay on demand in excess of the amount of the goods on hand is simply fraud, and should be so considered by the legal system. For this means that a bank issues “fake” warehouse receipts – warehouse receipts, for example, for ounces of gold that do not actually exist in the vaults. This is legalized counterfeiting; this is the creation of money without the necessity of production, to compete for resources against those who have produced. In short, I believe that fractional-reserve banking is disastrous both for the morality and for the fundamental bases and institutions of the market economy….”

8) Bernanke could not spot the housing bubble. Amazingly Bernanke thought the housing bubble was “well contained” right before it exploded in his face. Of course there is another possibility: Bernanke is a liar and knew it was not contained but did not want to say so.

9) Bernanke has no idea where interest rates should be. Of course no one else does either. But Bernanke thinks he does. The result is overshooting interest rate policy in both directions, just as Greenspan did. This is the Fed Uncertainty Principle Corollary Number One in action: The Fed has no idea where interest rates should be. Only a free market does. The Fed will be disingenuous about what it knows (nothing of use) and doesn’t know (much more than it wants to admit), particularly in times of economic stress.

10) Bernanke is a power grabbing hack. This is the Fed Uncertainty Principle Corollary Number Two in action: The government/quasi-government body most responsible for creating this mess (the Fed), will attempt a big power grab, purportedly to fix whatever problems it creates. The bigger the mess it creates, the more power it will attempt to grab. Over time this leads to dangerously concentrated power into the hands of those who have already proven they do not know what they are doing.

Summary:

Bernanke is a disingenuous liar with a memory problem. He is also an economic dunce who does not understand the cause of great depression nor could he spot a housing/credit bubble visible to nearly every blogger in the country. However, like his mentor Greenspan, Bernanke believes that every problem can be cured by throwing money at it. Finally, he is a creative, political power grabbing hack who gives memorable speeches about throwing money out of helicopters.

I have to hand it to Caroline. That is indeed a unique set of qualifications.

Bernanke’s four-year term ends in February, let us hope he is gone. Better yet, it’s time to Audit the Fed Then End It!

Mike “Mish” Shedlock

Monday, June 29, 2009

Source: GlobalEconomicAnalysis