Dr. Paul explains why “Cash for Clunkers” hurts poor people and is bad for the economy.

Added: August 03, 2009

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

Dr. Paul explains why “Cash for Clunkers” hurts poor people and is bad for the economy.

Added: August 03, 2009

From the article:

What Squalene Does to Rats

A 2000 study published in the American Journal of Pathology demonstrated a single injection of the adjuvant squalene into rats triggered “chronic, immune-mediated joint-specific inflammation,” also known as rheumatoid arthritis.[vii]

The researchers concluded the study raised questions about the role of adjuvants in chronic inflammatory diseases.

What Squalene Does to Humans

A study conducted at Tulane Medical School and published in the February 2000 issue of Experimental Molecular Pathology included these stunning statistics:

” … the substantial majority (95%) of overtly ill deployed GWS (Gulf War Syndrome) patients had antibodies to squalene. All (100%) GWS patients immunized for service in Desert Shield/Desert Storm who did not deploy, but had the same signs and symptoms as those who did deploy, had antibodies to squalene.

In contrast, none (0%) of the deployed Persian Gulf veterans not showing signs and symptoms of GWS have antibodies to squalene. Neither patients with idiopathic autoimmune disease nor healthy controls had detectable serum antibodies to squalene. The majority of symptomatic GWS patients had serum antibodies to squalene.”[xi]

According to Dr. Viera Scheibner, Ph.D., a former principle research scientist for the government of Australia:

“… this adjuvant [squalene] contributed to the cascade of reactions called “Gulf War Syndrome,” documented in the soldiers involved in the Gulf War.

The symptoms they developed included arthritis, fibromyalgia, lymphadenopathy, rashes, photosensitive rashes, malar rashes, chronic fatigue, chronic headaches, abnormal body hair loss, non-healing skin lesions, aphthous ulcers, dizziness, weakness, memory loss, seizures, mood changes, neuropsychiatric problems, anti-thyroid effects, anaemia, elevated ESR (erythrocyte sedimentation rate), systemic lupus erythematosus, multiple sclerosis, ALS (amyotrophic lateral sclerosis), Raynaud’s phenomenon, Sjorgren’s syndrome, chronic diarrhoea, night sweats and low-grade fevers.”[xii]

You will find more important information on swine flu at the end of this article.

According to Kathleen Sebelius, Secretary of the U.S. Department of Health and Human Services, your children should be the first target for mass swine flu vaccinations when school starts this fall.[i]

This is a ridiculous assumption for many reasons, not to mention extremely high risk.

In Australia, where the winter season has begun, Federal Health Minister Nicola Roxon is reassuring parents the swine flu is no more dangerous than regular seasonal flu. “Most people, including children, will experience very mild symptoms and recover without any medical intervention,” she said.[ii]

Sydney-based immunization specialist Robert Booy predicts swine flu might be fatal to about twice as many children in the coming year as regular influenza. Booy estimates 10-12 children could die from the H1N1 virus, compared with the five or six regular flu deaths seen among children in an average year in Australia.[iii]

Read moreSqualene: The Swine Flu Vaccine’s Dirty Little Secret Exposed

“Saud Masud, a real-estate analyst at UBS, said a decelerating price fall doesn’t necessarily point to market recovery. “The underlying trends are not supportive of a recovery in the market anytime soon,” he said.”

Related article: In Dubai, guest workers are stranded without jobs

Property prices in Dubai are down 50% from their peak in the third quarter of 2008.

DUBAI — Home values in Dubai have fallen by about half from their peak late last year in the wake of the global real-estate slowdown, a widely watched index of Dubai property prices showed Monday.

Property prices in the emirate, which had been driven sharply higher in past years as foreign investors snapped up real estate, have been sliding since the third quarter of 2008.

The Greatest Depression is already here.

– The Greatest Economic Collapse Is Coming:

“To give you an idea of how big a problem these deficits are, consider that the US government could tax its citizens 100% of their earnings and NOT have a balanced budget.” (!)

– Richard Fisher, president of the Dallas Federal Reserve Bank:

The“very big hole” in unfunded pension and health-care liabilities is over $99 trillion.

(Full article: Here)

– On the Edge with Max Keiser: The coming collapse of the US will be much worse than that of the USSR (07/31/09)

– Ben Bernanke: This financial crisis may be worse than the Great Depression

– Gerald Celente on Fox News: The Greatest Depression (05/31/09)

– Interview with Gerald Celente: 2009 – The Worst Economic Collapse Ever (02/10/09):

In 2009 we’re going to see the worst economic collapse ever, the ‘Greatest Depression’, says Gerald Celente, U.S. trend forecaster. He believes it’s going to be very violent in the U.S., including there being a tax revolt.

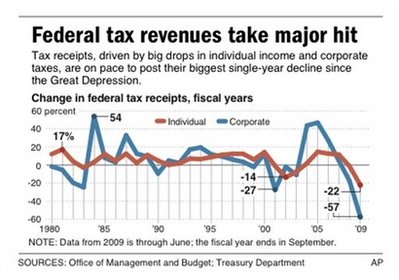

WASHINGTON – The recession is starving the government of tax revenue, just as the president and Congress are piling a major expansion of health care and other programs on the nation’s plate and struggling to find money to pay the tab.

The numbers could hardly be more stark: Tax receipts are on pace to drop 18 percent this year, the biggest single-year decline since the Great Depression, while the federal deficit balloons to a record $1.8 trillion.

Other figures in an Associated Press analysis underscore the recession’s impact: Individual income tax receipts are down 22 percent from a year ago. Corporate income taxes are down 57 percent. Social Security tax receipts could drop for only the second time since 1940, and Medicare taxes are on pace to drop for only the third time ever.

The last time the government’s revenues were this bleak, the year was 1932 in the midst of the Depression.

“Our tax system is already inadequate to support the promises our government has made,” said Eugene Steuerle, a former Treasury Department official in the Reagan administration who is now vice president of the Peter G. Peterson Foundation.

“This just adds to the problem.”

Vitamin D is very important for your health: Epidemic Influenza And Vitamin D

Go outside, learn from the greatest teacher (nature) and get a free dose of Vitamin D every day.

(PS: If you drink milk, then only drink organic, non-homogenized(!) milk.)

People who drank milk less than once a week were among those most at risk for vitamin-D deficiency, a study found.

A whopping 70 percent of American kids aren’t getting enough vitamin D, and such youngsters tend to have higher blood pressure and lower levels of good cholesterol than their peers, according to two new studies published this week in the journal Pediatrics. Low vitamin D levels also may increase a child’s risk of developing heart disease later in life, experts say.

![]() “We were astounded at how common it was,” says study author Dr. Michal Melamed, an assistant professor of medicine, epidemiology, and population health at the Albert Einstein College of Medicine, in the Bronx, New York. “There is a lot of data that suggests adults with low vitamin-D levels are at risk for diabetes, high blood pressure, cardiovascular disease, and a lot of cancers, and if kids start out with low levels and never increase them, they may be putting themselves at risk for developing all of these diseases at a much earlier age.”

“We were astounded at how common it was,” says study author Dr. Michal Melamed, an assistant professor of medicine, epidemiology, and population health at the Albert Einstein College of Medicine, in the Bronx, New York. “There is a lot of data that suggests adults with low vitamin-D levels are at risk for diabetes, high blood pressure, cardiovascular disease, and a lot of cancers, and if kids start out with low levels and never increase them, they may be putting themselves at risk for developing all of these diseases at a much earlier age.”

Vitamin D is often called the “sunshine vitamin” because the human body makes it only when exposed to sunlight — although it only takes 10 to 15 minutes a day to make an adequate amount. Vitamin D, which helps the bones better absorb calcium, is also added to multivitamins and milk.

Oh My God.

I write two Tickers on The FDIC and banks’ refusal to take their marks, and gee, you’d think someone over there might have read them!

SAN FRANCISCO (MarketWatch) — The Federal Deposit Insurance Corp. said late Monday that banks should recognize losses on home loans promptly and warned that failure to do so could delay efforts to mitigate the financial impact.

Institutions must analyze the collectibility of the loans they hold for investment at least every quarter, the FDIC said in a statement on its Web site.

Banks then have to keep an appropriate allowance for loan and lease losses, covering estimated credit losses on individually evaluated loans that are deemed to be impaired, and on groups of loans with similar risk characteristics, the regulator said.

That’s just too much.

Let me put it in simple English, Ms. Bair. Here ‘ya go, in formal letter format:

From: The Tickerguy

To: Ms. Sheila Bair, FDIC Chairwoman

Regarding: Your FDIC Statement Nonsense

Dear Ms. Bair;

You know full well that essentially every bank in the nation, including the largest ones that went through the so-called “Stress Tests”, have been intentionally mis-marking loans “held for investment” at or near par even when there is essentially no chance these loans will be satisfied in full, and that this practice has been going on since the housing crisis began.

These include defaulted loans; there are literally millions of Americans that are living rent-free, right now, because their lender has sent out a NOD and then done nothing else, despite never paying another penny toward their mortgage.

Why is the bank doing this?

That’s not hard to figure out.

If the banks foreclose and sell the property then the sale price becomes the indisputable mark to market on that paper, and avoiding that mark is absolutely critical or these banks would be forced to recognize their own insolvency.

Thus we have people who live in their houses for more than a year with nothing more than a NOD in the mailbox, we have people who have had their homes foreclosed upon and then the bank has refused to perfect title (leading to stories in the media of foreclosed owners being chased for neglected upkeep, code violations and similar) and we have banks that have made a practice of bidding themselves in the foreclosure auction for the full mortgage amount, which of course is dramatically more than anyone else will pay for it. They wind up “owning” their own foreclosure but the paper remains marked at the full mortgage amount, since that’s what they bid, even though there’s not a snowball’s chance in Hell that any real buyer would pay anything close to that amount (evidenced by the lack of bids at or above that amount at the auction!)

I have repeatedly stated (and shown my work) that there was likely $3 trillion in total “bad paper” in the banking system in residential mortgages alone.

We know for a fact that recovery is running in the neighborhood of 40% (including both first and second lines) from those loans that have been followed through from default to recovery. We know for a fact that bid lists of defaulted second lines circulate all the time and trade literally at a few pennies on the dollar; thus, a second line behind a defaulted first loan is essentially worth zero.

We also know that about $1 trillion in bad loans have been written down thus far, which means there is two trillion more to go, and then we get to talk about commercial real estate where “extend and pretend” has even become part of the vernacular of the trade!

Ms. Bair, this sort of misdirection is the worst sort of tripe. You have two banks with self-identified negative Tier Capital Ratios, a circumstance that is never supposed to happen, but it has.

You have a third identified bank that had its last real chance for a rescue evaporate Friday and it reported, at the same time, a quarterly loss of more than five times its market capitalization.

All three of these institutions should have been seized LAST FRIDAY, but there’s a problem with doing that, isn’t there Ms. Bair? It’s this table here showing how much money you have left in your insurance fund, and the average loss for a seized institution:

The last line in particular shows a paltry $8.26 billion dollars left. Now since the FDIC thinks its cute to be somewhat secret about exactly how much money it has (and what of that is committed) we don’t have hard numbers, but this was a “best guess” sent to me the other night – and it looks about right.

So exactly how do you intend to close those three (and the other few hundred similarly-situated) banks and make sure Granny gets her $20,000 life savings back? With your good looks? Yes, I know, you have a potential $500 billion credit line from Treasury, but that line isn’t funded and in order to do so Turbo Tax Timmy would have to go auction off another $500 billion in Treasuries, and there might be a tiny problem with doing that, given the insane rate of issuance already taking place.

Read moreFDIC “Tells Banks” To Quit Cooking The Books! ROFL!

– Germany: BND denies report on Iran bomb timing; Iran not be able to produce an atomic bomb for years (Reuters)

July 31 (Bloomberg) — The U.S. Defense Department wants to accelerate by three years the deployment of a 30,000-pound bunker-buster bomb, a request that reflects growing unease over nuclear threats from Iran and North Korea.

Comptroller Robert Hale, in a formal request to the four congressional defense committees earlier this month, asked permission to shift about $68 million in the Pentagon’s budget to this program to ensure the first four bombs could be mounted on stealthy B-2 bombers by July 2010.

Hale, in his July 8 request, said there was “an urgent operational need for the capability to strike hard and deeply buried targets in high-threat environments,” and top commanders of U.S. forces in Asia and the Middle East “recently identified the need to expedite” the bomb program.

The bomb would be the U.S. military’s largest and six times bigger than the 5,000-pound bunker buster that the Air Force now uses to attack deeply buried nuclear, biological or chemical sites.

Accelerating the program “is intended to, at the very least, give the president the option of conducting a strike to knock out Iran’s main uranium enrichment capabilities,” said Ken Katzman, Middle East military expert for the non-partisan Congressional Research Service.

Read morePentagon: Eyeing Iran, Wants to Rush 30,000-Pound Bomb Program

The UK government is about to spend $700 million dollars installing surveillance cameras inside the private homes of citizens to ensure that children go to bed on time, attend school and eat proper meals.

No you aren’t reading a passage from George Orwell’s 1984 or Aldous Huxley’s Brave New World, this is Britain in 2009, a country which already has more surveillance cameras watching its population than the whole of Europe put together.

Now the government is embarking on a scheme called “Family Intervention Projects” which will literally create a nanny state on steroids, with social services goons and private security guards given the authority to make regular “home checks” to ensure parents are raising their children correctly.

Telescreens will also be installed so government spies can keep an eye on whether parents are mistreating kids and whether the kids are fulfilling their obligations under a pre-signed contract.

Around 2,000 families have been targeted by this program so far and the government wants to snare 20,000 more within the next two years. The tab will be picked up by the taxpayer, with the “interventions” being funded through local council authorities.

Read moreUK: Government To Install Surveillance Cameras In Private Homes

samples from ‘super human radio’ – Carl Lanore speaking with Aajonus Vonderplanitz

song credits

Rap 1/production: trillion

Rap 2: Pataphysics

Chorus: Project nRt

keys by: Mark Duff

female vocal: Devika

trillion lyrics:

I put the needle to the record cos the needle is defective

and the needle breaks the record when the needle is the method

for prevention of the fever bringin death to the receiver

there’s no effort in believing that the method feeds the fever

see the leader – diseases are invented in a lab

one believes it on reading recent mentions of the jab

centered in a grand scab of corruption and lies,

injecting views of doom from news room into the public eye

but now the floor has risen on a cause of autism

doctors show research and scores applaud with ’em

it’s mercury in vaccines often there’s more given

peace ignored and forbidden cos profit is war driven

profit? A Score billion – on vaccines alone

and the government dont care – theyre always taxing the clones

and the CDC is right behind this rolling cart,

part involved from the start in this evolving art

of Big Pharma Big Deception, Obama – Big Karma:

enter Wyeth, Roche, Bayer and Baxter Healthcare (and co)

all a sordid history with stacks of health scares

you got HIV and bird flu mixed up in the shots

Ive been connecting the dots between the money that swaps?

conspiracy? Yeah I sense a couple of plots.

but there is one little word that could save your health, just say NO, say NO to the vaccine.

and if the doctor says YES, then make him take it himself – just say NO, say NO to the vaccine.

there is one little word that could save your health, just say NO, say NO to the vaccine.

and if Lawman says YES, then make him take it himself – just say NO, say NO to the vaccine.

(then pat says)

I dont need your prescription

I aint go not affliction

Corporate pharmaceutical

Teaming with politician

Put them on proscription

That should be our own decision

Whether we want spending on vaccines

Or health and education

Soon they enlist

The general populous,

They adding to the list

pharmaceutical benefits

Well its thin line

Glaxo Smith Klien,

profit margin fine

still aint seen a diseased

mad cow, coughing bird, or swine

depopulation linked, with-holding vaccines

rather let a product lapse than save some human beings

now theyre busy counting there beans

So they wont hear us runnin up on the machine

another new flu that is the biggest threat

What about an aging population with no safety net,

so we continue to believe everything we read,

There just aint No taste in the news feed…

(back to trillion)

Weapons of trial and error, were smiling in terror at the doctor and nurse

take a hold of yourself and control of your health and say no, why dont you go first!

so where was i, conspiracies, secret ops and spy stations

and the catch word of the year – Depopulization

but humans generally are hard to kill, even with a jar of pills,

that’s why the politicians have to pass a bill, for compulsory Gardasil

from Malta to Dargaville. and farther still,

another bill protects the maker Merck

from liability for illness and deaths that may occur

cos infertility and cancer are hidden inside the prick

and immune disorders have you bedridden, retired and sick

research is your friend – knowledge keeping is king

every vaccine has a poisoned dollar deep in it’s sting

theres no master flu, theyre just after me and you

the last dance is due now their mask is see-through

SARS was a cheats sweep through, swine flu – a scam too,

designed to make a trillion bucks on out of date tamiflu

Manufactured viruses – biological war-fares,

Psychological torture – jail or jab! Dial some more prayers.

our bodies are designed to fight – those bugs intrudin

But only when our diet is right dont shove junk food in!

SAY NO TO THE VACCINE

Got a problem?

Do some research…

Read moreThe Vaccine Song: SAY NO TO THE VACCINE by trillion (feat. pataphysics & nRt)

Max Keiser compares the collapse of the US and the USSR … and more.

1 of 3:

2 of 3:

Related info: US Military To Work With FEMA During Swine Flu Pandemic

Important timeline of video:

1:40 Vaccines acquired immunity is temporary while immunity gained after recovering from influenza is longer lasting.

3:10 Few choices will be allowed and every child from 6 months to 18 years must have an annual flu shot.

3:22 Call by American health officials to give the first doses of experimental swine flu vaccines in a school setting.

3:45 Now a flu pandemic raised to phase 6 which is equivalent to homeland securities Code Red warning of an imminent terrorist attack.

4:08 When the CDC declares a public health emergency that declaration allows the food and drug administration to fast track experimentation drugs and vaccines which do not have to be tested as thoroughly as others which go through the normal FDA process.

4:35 Congress has given a group of drug companies $1 billion to fast track experimental swine flu vaccines.

4:55 People who already have sensitive immune systems will be particularly at risk of the experimental vaccines.

5:10 State officials are allowed to enter homes and businesses without the consent of the occupants to investigate and quarantine individuals without their consent.

6:30 Public demonstrations are classed as low level terrorism.

6:45 Plans are being made to make selected airports quarantine centers where airplanes will be rerouted for passenger health inspection.

7:00 Experimental vaccines to be given first to children in schools.

Flashback:

– Government Insider: Bush Authorized 9/11 Attacks:

“This (9/11) was all planned. This was a government-ordered operation. Bush personally signed the order. He personally authorized the attacks. He is guilty of treason and mass murder.”

“Bush personally ordered it to happen. We have some very incriminating documents as well as eye-witnesses, that Bush personally ordered this event to happen in order to gain political advantage, to pursue a bogus political agenda on behalf of the neocons and their deluded thinking in the Middle East..”

Edmonds expert fills in details from recent BRAD BLOG interview with noted, gagged FBI translator/whistleblower…

|

During my recent interview with FBI translator-turned-whistleblower Sibel Edmonds on the Mike Malloy Show, a caller had asked her opinion on whether she believed 9/11 to have been “an inside job”.

Edmonds replied by first specifying “As I have done for the past 7 or 8 years, I have basically stuck with what I know, first-hand, directly, my own knowledge, based on my own experience, based on what I obtained, which is not a lot, but it is extremely important.”

After explaining the difference between what she does and doesn’t know first hand, she went on to explain: “I have information about things that our government has lied to us about. I know. For example, to say that since the fall of the Soviet Union we ceased all of our intimate relationship with Bin Laden and the Taliban – those things can be proven as lies, very easily, based on the information they classified in my case, because we did carry very intimate relationship with these people, and it involves Central Asia, all the way up to September 11.” …

Her complete response, pulled from the lengthy interview (full, commercial-free audio here) has been transcribed by Luke Ryland, perhaps the world’s foremost expert in all things Sibel Edmonds related.

Today in a highly-recommended diary at dKos, Ryland filled in a good junk of details from Edmonds’ references, reporting that her comments are, in fact, a “bombshell”…

Former FBI translator Sibel Edmonds dropped a bombshell on the Mike Malloy radio show, guest-hosted by Brad Friedman (audio, partial transcript).

In the interview, Sibel says that the US maintained ‘intimate relations’ with Bin Laden, and the Taliban, “all the way until that day of September 11.”

These ‘intimate relations’ included using Bin Laden for ‘operations’ in Central Asia, including Xinjiang, China. These ‘operations’ involved using al Qaeda and the Taliban in the same manner “as we did during the Afghan and Soviet conflict,” that is, fighting ‘enemies’ via proxies.

As Sibel has previously described, and as she reiterates in this latest interview, this process involved using Turkey (with assistance from ‘actors from Pakistan, and Afghanistan and Saudi Arabia’) as a proxy, which in turn used Bin Laden and the Taliban and others as a proxy terrorist army.

After filling in many of the details, with scores of informational links to support the allegations, Ryland summarizes thusly:

The bombshell here is obviously that certain people in the US were using Bin Laden up to September 11, 2001.

It is important to understand why: the US outsourced terror operations to al Qaeda and the Taliban for many years, promoting the Islamization of Central Asia in an attempt to personally profit off military sales as well as oil and gas concessions.

The silence by the US government on these matters is deafening. So, too, is the blowback.

Read his full diary here, along with the (currently) 445 comments in response to it.

By Brad Friedman on 7/31/2009 1:07PM

Source: The Brad Blog

Joe Saluzzi talks on Bloomberg and explains how machine trading is distorting the financial markets.

Added: July 06, 2009

Debate: Despite its obvious benefits organic food continues to be denigrated by the political and corporate establishment in Britain

Despite its obvious benefits for our health and for the environment, organic food continues to be denigrated by the political and corporate establishment in Britain.

The food industry, in alliance with pharmaceutical and big biotechnology companies, has waged a long, often cynical campaign to convince the public that mass-produced, chemically-assisted and intensively-farmed products are just as good as organic foods, despite mounting evidence to the contrary.

The latest assault in this propaganda exercise comes from the Food Standards Agency, the government’s so-called independent watchdog, which has just published a report claiming that there is no nutritional benefit to be gained from eating organic produce.

Those forces bent on promoting GM crops and industrialised production, would have been delighted by the widespread media coverage of the Agency’s report, portraying enthusiasm for organic foods as little more than a fad among neurotic consumers that would pass once the public is given the correct information.

But what is truly misguided is not the increasing popularity of organic goods, but the Food Standards Agency’s determination to halt this trend and instead promote genetic modification.

The new report from the FSA highlights this. For all the publicity it has attracted, the document does not contain any new material.

In fact, it is just an analysis of existing research carried out by other bodies. Moreover, the organisation that conducted this second-hand study, the London School of Hygiene and Tropical Medicine, is not renowned as a leading centre in this field.

Indeed, there is far more significant work currently being done on organic foods by several other bodies, some of it funded by the European Union, though the FSA has chosen to ignore it.

It is difficult to avoid the conclusion that the FSA has decided to give such loud backing to this report because it can bend the findings to suit its political, pro-GM, anti-organic agenda.

What is truly misguided is not the increasing popularity of organic goods, but the Food Standards Agency’s determination to instead promote genetic modification

Ever since its creation in 2000, the Food Standards Agency has been biased against organic farming. The first chairman, Sir John Krebs (“Krebs” by the way is the German word for “Cancer”. – Infinite Unknown) , was supportive of the biotechnology lobby and only too keen to promote GM as the future of farming.

Read moreA cancerous conspiracy to poison your faith in organic food

Aug. 1 (Bloomberg) — Banks in New Jersey, Ohio, Florida, Oklahoma and Illinois were shut, pushing the toll of failed U.S. lenders to 69 this year, amid a 26-year high in unemployment and the worst economic slump since the Great Depression.

The Federal Deposit Insurance Corp. was named the receiver of the five banks, the regulator said yesterday in e-mailed statements. The seized banks, with total assets of $2.69 billion and deposits of $2.56 billion, will cost the FDIC’s insurance fund about $911.7 million.

Mutual Bank of Harvey, Illinois, was the biggest of yesterday’s failures, with $1.6 billion in assets and the same amount in deposits. Peoples Community Bank in West Chester, Ohio, was second, with $705.8 million in assets and $598.2 million in deposits. Also shuttered were New Jersey’s First BankAmericano, Integrity Bank in Florida and First State Bank of Altus, Oklahoma.

July 31 (Bloomberg) — The first 12 months of the U.S. recession saw the economy shrink more than twice as much as previously estimated, reflecting even bigger declines in consumer spending and housing, revised figures showed.

The world’s largest economy contracted 1.9 percent from the fourth quarter of 2007 to the last three months of 2008, compared with the 0.8 percent drop previously on the books, the Commerce Department said today in Washington.

“The current downturn beginning in 2008 is more pronounced,” Steven Landefeld, director of the Commerce Department’s Bureau of Economic Analysis, said in a press briefing this week. The revisions were in line with past experience in which initial figures tended to underestimate the severity of contractions during their early stages, he said.

The updated statistics also showed that Americans earned more over the last 10 years and socked away a larger share of that cash in savings. The report signals the process of repairing tattered balance sheets following the biggest drop in household wealth on record may be further along than anticipated.

Spending Slumps

Consumer spending, which accounts for 70 percent of the economy, decreased 1.8 percent in last year’s fourth quarter from the same period in 2007, exceeding the prior estimate of a 1.5 percent drop. Purchases also began sinking sooner than previously projected, registering their first decline at the start of 2008 rather than in the second half.

Read moreUS economy shrinks more than twice as much as previously estimated

Both. The US will default on its debt and the dollar will be destroyed.

Looks like what I have warned all along may be coming to pass sooner than even some of the most bearish investors expected.

It may be not tomorrow but it is coming … and it is soon coming to other countries (UK) too.

Now what people? Land of the poor and home of the slaves? Wake up America!

– Ben Bernanke: This financial crisis may be worse than the Great Depression

The Greatest Depression is here.

I have a very disturbing pattern here on a few charts today….

The dollar is getting trashed.

10 year bond futures are skyrocketing (yield collapsing); the yield gapped under a “must hold” trendline this morning and has continued down since.

What is this all telling us?

It appears to be that traders in the FX market (who by the way tend to be smarter than the average equity or bond trader) have deduced that the entire “improvement” in 2Q GDP came from government spending.

Well that’s not hard to figure out – it did.

They also appear to be making a bet that the US Government will attempt to continue this, along with The Fed monetizing the debt through its buyback programs to destruction of both the government and currency.

This is not positive for our economy. At all.

But this is the meme today – traders are piling into bonds expecting more Fed buybacks, they are shorting dollars like crazy, and Gold is of course reacting to these two facts.

This is a “collapse of government due to spending into bankruptcy” play folks, or at minimum “currency crisis around the corner.”

Right or wrong this is the trade being put on in size; the dollar selling in particular is especially pernicious and troublesome – that chart is essentially straight down since the GDP release this morning.

Read moreCollapse of government due to spending into bankruptcy or “only” a currency crisis?

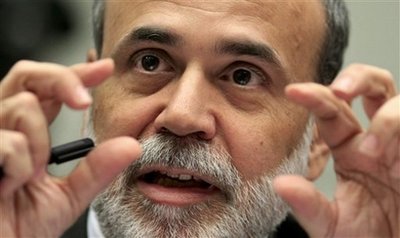

WASHINGTON (MarketWatch) — Federal Reserve Board Chairman Ben Bernanke discussed the economy with average Americans on Sunday, saying the current financial crisis could be even more virulent than the Great Depression.

“A lot of things happened, a lot came together, [and] created probably the worst financial crisis, certainly since the Great Depression and possibly even including the Great Depression,” Bernanke said at the start of a town-hall meeting in Kansas City.

Read moreBen Bernanke: This financial crisis may be worse than the Great Depression