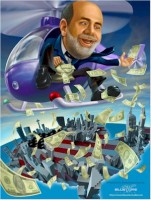

Looks like the ECB has now the ‘Bernanke’ virus.

Now all the Illuminati banksters are printing money which increases the money supply and that is called inflation … and inflation is nothing more than a hidden tax.

“The U.S. Federal Reserve, the Bank of England and Bank of Japan have lowered rates close to zero and are already buying bonds, effectively printing money to reflate their economies in a policy known as quantitative easing. “

Quantitative easing should be better called ‘ruthless stealing’ instead:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

Got gold … and silver?

May 7 (Bloomberg) — European Central Bank President Jean- Claude Trichet said the ECB unanimously agreed on a 60 billion- euro ($80.5 billion) plan to buy bonds as officials step up their response to the worst recession since World War II.

“The Governing Council has decided in principle that the eurosystem will purchase euro-denominated covered bonds issued in the euro area,” Trichet told reporters in Frankfurt. He said the bank’s main interest rate, which it cut by a quarter point to a record low of 1 percent today, is appropriate and that the ECB will extend its unlimited auctions of funds to banks.

ECB officials have spent the past months bickering over whether to fight a recession by purchasing assets, with Bundesbank President Axel Weber leading resistance to such a move. The U.S. Federal Reserve, the Bank of England and Bank of Japan have lowered rates close to zero and are already buying bonds, effectively printing money to reflate their economies in a policy known as quantitative easing.

“The ECB surprised in a good way,” said Natacha Valla, an economist at Goldman Sachs Group Inc. in Paris who used to work at the ECB. While “they took a little too long” in announcing it, “60 billion is not insignificant. It’s more than symbolic.”

The euro rose as much as 1 percent against the dollar to $1.3470. Separately, the Bank of England kept its key interest rate at a record low of 0.5 percent today and said it will increase bond purchases by 50 billion pounds ($75 billion).

Covered Bonds

Today’s decision marks a setback for Weber who had argued that debt purchases “shouldn’t take priority” over other measures to tackle the economic crisis. That put him at odds with officials such as Greece’s George Provopoulos and Cyprus’s Athanasios Orphanides who wanted to keep open the option of such a move to combat deflation risks.

“The Rubicon that’s been crossed is that it will be accepting private credit risk on its balance sheet, which central banks had tried to avoid,” said David Tinsley, an economist at National Australia Bank in London. “Though covered bonds are safe assets, they’re exposing themselves to a certain amount of credit risk.”

The Governing Council also extended the maturity of its liquidity-providing operations to 12 months and decided that the European Investment Bank can participate in the ECB’s money- market auctions. That may ease financing for the small and medium-sized companies that the government-backed EIB lends to.

Stick to Plan

The ECB is focusing its efforts on reviving interbank lending. Almost three quarters of European companies’ financing comes from banks rather than the capital markets, which carry more influence in the U.S.

“It seems to stick to its plan to do everything in its power to help improve the functioning of the euro-area banking system,” said Elga Bartsch, chief European economist at Morgan Stanley in London.

Trichet dodged questions about how the ECB will fund the bond purchases and said technical details will be announced next month. The ECB plan is equivalent to about 0.5 percent of euro region GDP. That compares to debt purchase programs in the U.K. and the U.S. amounting to 8 percent and 2 percent of GDP respectively, says Lloyds TSB Group Plc.

Covered bonds, known as Pfandbriefe in Germany, are secured by property loans or lending to public-sector institutions. They differ from mortgage-backed securities because they’re also supported by a borrower’s pledge to pay. They have traditionally been considered among the safest corporate bonds available, allowing lenders to pay less interest.

German Bonds

There were about 1.5 trillion euros of the securities outstanding in the euro region as of the end of 2007, 900 billion euros of which were German, according to BNP Paribas SA. That may make buying covered bonds easier for the Bundesbank to accept, says Nick Kounis at Fortis Bank in Amsterdam.

“I can’t see the Bundesbank having had big objections to” to buying covered bonds, which are “very, very widely” used in Germany, said Kounis, chief European economist at Fortis.

While Trichet refused to exclude the chance of further cuts, he said the current level of rates is “appropriate,” language used in the past to signal that they will stay unchanged for now.

The ECB is deploying new tools as the pace of decline in Europe’s service and manufacturing industries eases. Economic confidence rose in April after 11 months of declines.

“The latest economic data suggest tentative signs of stabilization at very low levels after a first quarter that was significantly weaker than expected,” Trichet said. “Overall, economic activity is likely to remain very weak for the reminder of the year before gradually recovering in 2010.”

To contact the reporter on this story: Jana Randow in Frankfurt [email protected].

Last Updated: May 7, 2009 11:53 EDT

Source: Bloomberg