– Suspicions grow that attack was ‘inside job’ (Independent):

Conspiracy theories fuelled by security lapses as hunt for gunmen continues

– Venezuela’s Hugo Chavez tightens state control of food amid rocketing inflation and food shortages (Telegraph):

Venezuela’s public finances are unravelling, with oil prices at $40 a barrel, while the national budget is calculated at $60 a barrel. Inflation is running at over 30 per cent, yet with the new measures Mr Chavez is seeking to ensure that his core support, the poor, can still fill their shopping baskets with food.

– Iran says its missiles could reach Israel’s nuclear facilities (Telegraph):

The country’s military chief, Gen Mohammad Ali Jafari, said Iran now has a mighty military force capable of deterring any US or Israeli attack. “All nuclear facilities in various parts of the lands under occupation of the Zionist regime are within the range of Iran’s missiles,” the official IRNA news agency quoted Jafari as saying Wednesday.

– Ukraine in new gas showdown with Russia (Independent):

Police raid state energy firm days ahead of deadline for next gas payment:

Armed agents of Ukraine’s national security service raided the head office of the state energy company, Naftogaz, in Kiev yesterday, as part of an investigation into the alleged diversion of gas.

– Now As The Much Greater Depression Progresses (International Forecaster)

– US military chief to offer help to Mexico in violent drug war (AFP):

WASHINGTON (AFP) — America’s top military officer heads to Mexico this week to offer help to a government battling powerful drug cartels, amid alarm in Washington over escalating violence across the border.

– NKorea threatens SKorean planes amid tensions (AP):

SEOUL, South Korea – North Korea threatened South Korean passenger planes flying near its airspace on Thursday and accused the U.S. and South Korea of attempting to provoke a nuclear war with upcoming joint military drills.

– US private sector cuts 697,000 jobs (Financial Times):

“The nightmare continues,” said Ian Sheperdson, chief US economist at High Frequency Economics. “Every indicator tells us that employment is tanking across the economy.”

– Citigroup Falls Below $1 as Investor Faith Erodes (Bloomberg):

March 5 (Bloomberg) — Citigroup Inc., once the world’s biggest bank by market value, dropped below $1 in New York trading for the first time as investors lose confidence the shares can recover after more than $37.5 billion in losses and a government rescue.

– Beer tax increases cost 20000 jobs so far (Guardian):

A record 2,000 British pubs have closed with the loss of 20,000 jobs since the chancellor, Alistair Darling, increased beer tax in the 2008 budget, new figures published by the British Beer and Pub Association reveal today.

– GM’s auditors raise the specter of Chapter 11 (Houston Chronicle):

DETROIT (AP) — General Motors Corp.’s auditors have raised “substantial doubt” about the troubled automaker’s ability to continue operations, and the company said it may have to seek bankruptcy protection if it can’t execute a huge restructuring plan.

– Fed Refuses to Release Bank Data, Insists on Secrecy (Bloomberg):

March 5 (Bloomberg) — The Federal Reserve Board of Governors receives daily reports on bailout loans to financial institutions and won’t make the information public, the central bank said in a reply to a Bloomberg News lawsuit.

– One in 8 US homeowners late paying or in foreclosure (Reuters):

NEW YORK, March 5 (Reuters) – About one in eight U.S. homeowners with mortgages, a record share, ended 2008 behind on their loan payments or in the foreclosure process as job losses intensified a housing crisis spawned by lax lending practices, the Mortgage Bankers Association said on Thursday.

– World’s poor suffering most in the credit crunch (Guardian):

The credit crunch is hitting the income of the world’s poorest people the most and will make the UN’s Millennium Development Goals more difficult to achieve than ever, according to research released today. The Global Monitoring Report from Unesco estimates the 390 million poorest Africans will see their income drop by around 20% – far more than in the developed world.

– JPMorgan, Wells Fargo, Bank America Face Ratings Cuts (Bloomberg):

March 5 (Bloomberg) — JPMorgan Chase & Co., Wells Fargo & Co. and Bank of America Corp., the three largest U.S. banks by market value, may face credit-rating downgrades by Moody’s Investors Service amid signs they’ll set aside additional cash for loan losses.

– Rights versus liberty (Guardian):

Hidden by the spirit of the Convention On Modern Liberty was a row about the Human Rights Act, which I want to bring out into the open

– Pakistan poses global security worry, says top US official (Guardian):

The top US diplomat in Kabul warned yesterday that Pakistan posed a bigger security challenge to America and the world than Afghanistan, as Islamabad grappled with the latest terrorist attack on its soil and the escalating Taliban insurgency on its north-western border.

– Merrill Lynch executives subpoenaed over bonuses (Guardian):

The row over bankers’ bonuses has intensified after subpoenas were issued to several top Merrill Lynch executives over payments for last year.

– Obama bid to stamp out tax havens (Guardian):

The world’s most secretive tax havens are to be prised open after Barack Obama’s new administration endorsed far-reaching legislation to crack down on them.

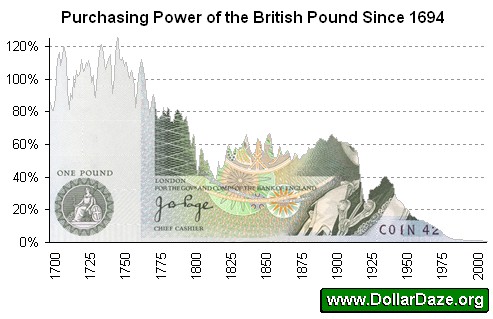

– Bank cuts rates by 50 points to 0.5% (Financial Times):

The Bank of England’s monetary policy committee cut its key rate by half a percentage point to 0.5 per cent on Thursday and unveiled a programme under which it will buy up to £150bn in government gilts and corporate bonds.

It is the first European central bank to begin this process – known as quantitative easing – in an effort to kick-start demand. (The Zimbabwe school of economics)

– Pimco Says Closed-End Funds Delay Dividend Payments (Bloomberg):

March 2 (Bloomberg) — Pacific Investment Management Co. said three of its closed-end funds had postponed dividend payments declared Feb. 2 because they failed to meet the ratio of assets to borrowing set by regulators.

– Bogus peer Hugh Rodley tried to pull off world’s biggest bank raid (Times Online):

A fake British aristocrat was convicted yesterday of playing a leading role in an audacious attempt to carry out the world’s biggest bank raid.

– Snow closes roads and railways in southern England (Guardian):

Snow has returned to parts of southern England with blizzards closing several roads and freezing temperatures bringing rail services to a standstill. (Global Freezing)

– US court allows man to sue Vatican over sexual abuse by priest (Telegraph):

A US federal appeals court has opened the way for a man to sue the Vatican after he was allegedly sexually abused 40 years ago as a teenager by a Roman Catholic priest.

– Patients can sue drug companies, Supreme Court rules (Chicago Tribune):

Patients have the right to sue drug companies when they’ve been harmed by medications whose risks aren’t adequately disclosed, the Supreme Court ruled today in an important 6-3 decision.

– Two-year-old girl can see for the first time following stem cell treatment (Telegraph):

The £30,000 treatment, which involves stems cells taken from an umbilical cord being fed into her forehead, has allowed her to see people, objects, colours and lights around her.